Check Point® Software Technologies Ltd.(link is external) has been recognized on Newsweek’s 2025 list of America’s Best Cybersecurity Companies(link is external).

Application Programming Interfaces (APIs) are a critical component of software development and allow developers to build applications and microservices more rapidly. The second annual RapidAPI Developer survey (conducted at the end of 2020) asked 1500 developers, executives, and engineering managers about their API usage and other technology trends. The survey found API adoption increased across all industries, with executives prioritizing investments in the API economy.

Developers Across All Industries Used More APIs in 2020 ...

The survey confirms what many developers already expected to see — API usage continues to grow at a rapid rate.

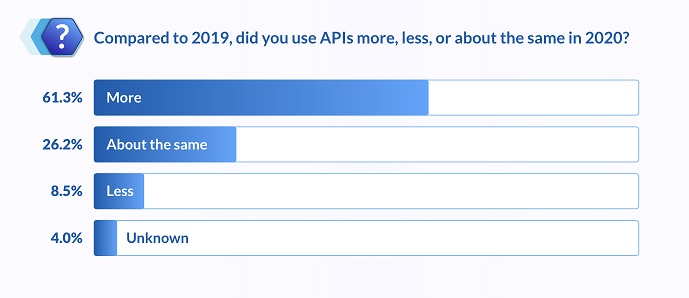

61.3% of respondents used more APIs in 2020 compared to 2019. An additional 26.2% reported using APIs about the same amount in 2019 and 2020.

This shows a strong interest in APIs and microservices by developers from all industries, backgrounds, and experience levels.

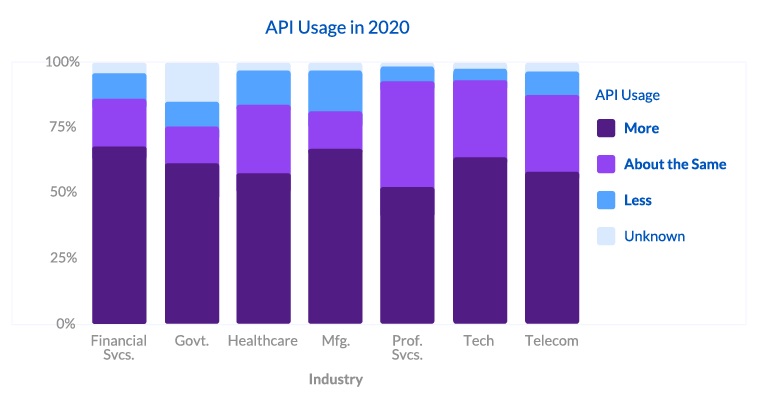

When we take a closer look at the responses, all of the industries included in the survey show increased API usage in 2020. The 3 industries with the highest percentage of developers reporting increased API usage are Financial Services (68.6%), Manufacturing (67.7%), and Technology (64.7%).

... and Expect to Use Even More APIs in 2021

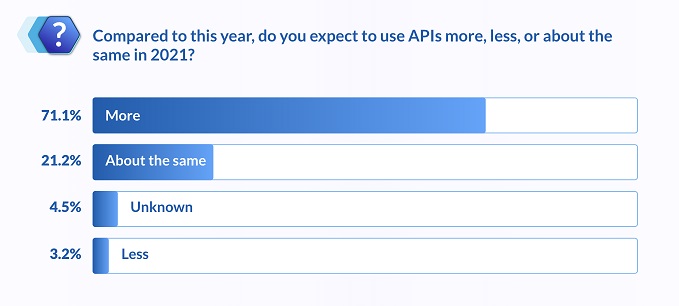

API usage is poised to grow even more throughout 2021. The survey found 71.1% of developers expect to use more APIs in 2021 than 2021, and an additional 21.2% plan to use about the same amount.

This supports the prioritization of digital transformation by many companies, which has been spurred in part by the COVID-19 pandemic and rise of remote work.

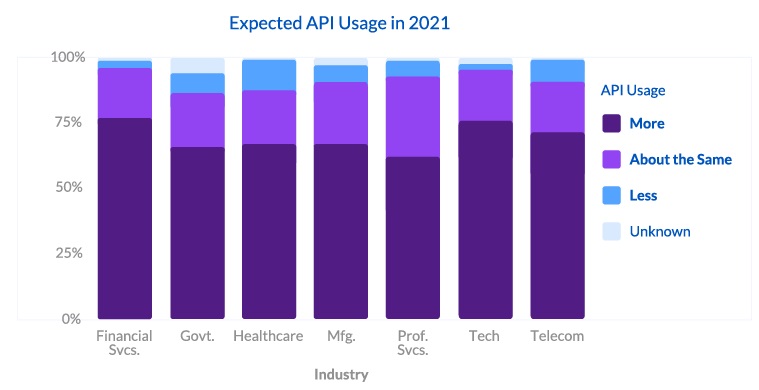

We see this overwhelming trend towards increasing API usage across all industries that were included in the survey. There is some variance if we look at the breakdown by industry.

The 3 industries with the highest percentage of developers expecting to use more APIs in 2021 compared to 2020 are Financial Services (77.3%), Technology (76.2%), and Telecommunications (71.4%).

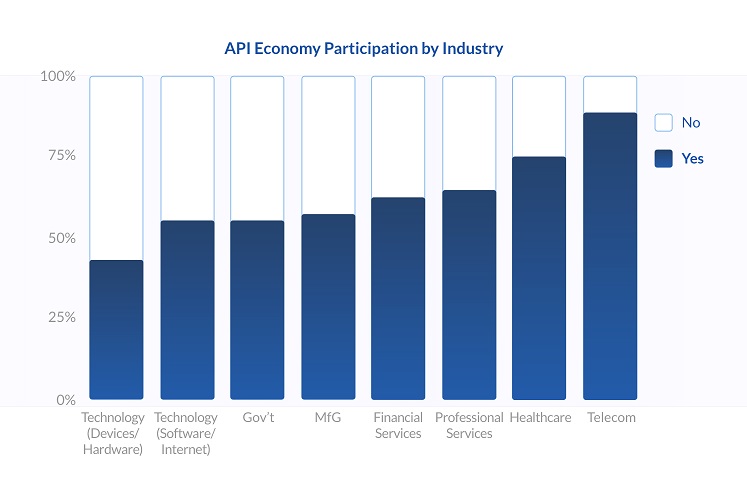

Executives Prioritize Participation in the API Economy

It's not just developers who report increased interest and usage of APIs. Across all industries, 58% of executives in the survey said participating in the API economy was a top priority for their organization.

This number was even more prominent in certain industries including telecommunications (89%), healthcare (75%), and financial services (62%).

Executives are prioritizing involvement in the API economy for a variety of reasons, including potential profits, competitive outlook, and regulatory requirements.

For example, traditional Telcom providers have been exposing APIs to consumers and partners, in order to compete with newer companies like Twilio. This provides a potential opportunity for increasing profits and allows them to stay relevant in the changing industry landscape.

Additionally, standards and regulations are driving increasing participation in the API economy. Examples include Fast Healthcare Interoperability Resources (FHIR) and the Open API Initiative which are critical to healthcare and financial services.

These trends are likely to expand into other industries in 2021 and beyond.

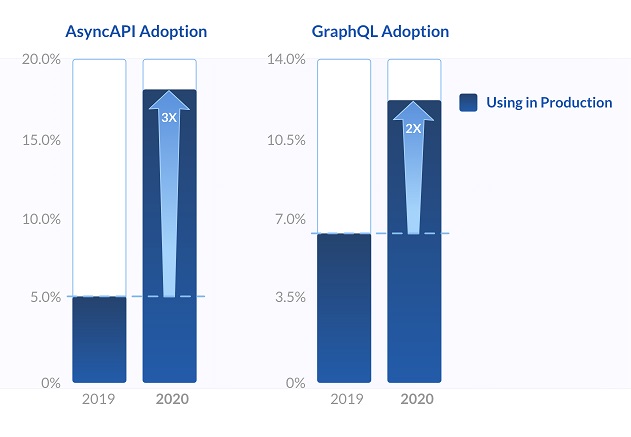

Interest in New API Technologies Accelerates

As APIs become more pervasive, interest in new API technology also grows. The 2019 and 2020 surveys both questioned participants about their usage of several established and emerging API technology trends.

Trends featured in both years of the survey include SOAP, REST, GraphQL, gRPC, and more.

Most notably, the survey saw major increases in two areas — AsyncAPIs and GraphQL. The number of developers using AsyncAPIs in production more than tripled from 5% in 2019 to over 19% in 2020. Likewise, the number of developers using GraphQL doubled from 6% in 2019 to 12% in 2020.

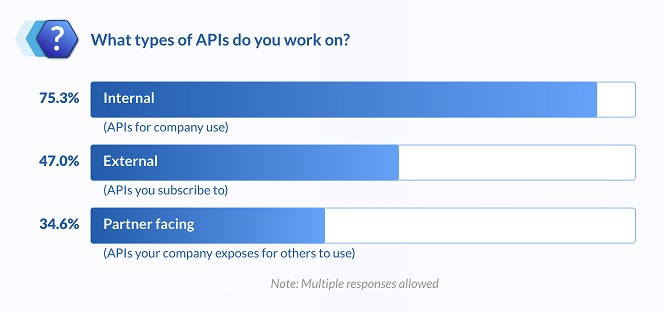

Increased Investment in Developing Internal APIs

Companies aren't just investing resources to expose APIs for consumers and partners — there is also growing investment in developing internal APIs and microservices.

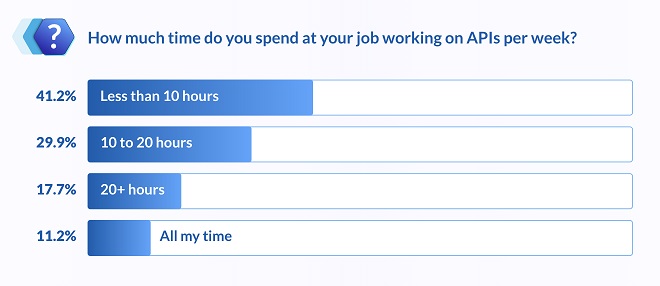

The survey found nearly 40% of the largest organizations have over 250 internal APIs. On top of this, 75% of developers reported working on internal APIs for their organization. This was a larger percentage than the developers who reported working on external APIs (47%) or partner-facing APIs (34%).

With nearly 60% of developers spending 10 or more hours a week working on APIs, it is clear organizations are investing a significant amount of time and resources to develop internal APIs.

Key Takeaway

If 2020 proved one thing — it's that the road ahead is unpredictable and uncertain. It also proved that APIs and microservices are here to stay, and continued investment in these areas will be the key for many companies as they navigate 2021 and beyond.

Industry News

Red Hat announced enhanced features to manage Red Hat Enterprise Linux.

StackHawk has taken on $12 Million in additional funding from Sapphire and Costanoa Ventures to help security teams keep up with the pace of AI-driven development.

Red Hat announced jointly-engineered, integrated and supported images for Red Hat Enterprise Linux across Amazon Web Services (AWS), Google Cloud and Microsoft Azure.

Komodor announced the integration of the Komodor platform with Internal Developer Portals (IDPs), starting with built-in support for Backstage and Port.

Operant AI announced Woodpecker, an open-source, automated red teaming engine, that will make advanced security testing accessible to organizations of all sizes.

As part of Summer '25 Edition, Shopify is rolling out new tools and features designed specifically for developers.

Lenses.io announced the release of a suite of AI agents that can radically improve developer productivity.

Google unveiled a significant wave of advancements designed to supercharge how developers build and scale AI applications – from early-stage experimentation right through to large-scale deployment.

Red Hat announced Red Hat Advanced Developer Suite, a new addition to Red Hat OpenShift, the hybrid cloud application platform powered by Kubernetes, designed to improve developer productivity and application security with enhancements to speed the adoption of Red Hat AI technologies.

Perforce Software announced Perforce Intelligence, a blueprint to embed AI across its product lines and connect its AI with platforms and tools across the DevOps lifecycle.

CloudBees announced CloudBees Unify, a strategic leap forward in how enterprises manage software delivery at scale, shifting from offering standalone DevOps tools to delivering a comprehensive, modular solution for today’s most complex, hybrid software environments.

Azul and JetBrains announced a strategic technical collaboration to enhance the runtime performance and scalability of web and server-side Kotlin applications.

Docker, Inc.® announced Docker Hardened Images (DHI), a curated catalog of security-hardened, enterprise-grade container images designed to meet today’s toughest software supply chain challenges.

GitHub announced that GitHub Copilot now includes an asynchronous coding agent, embedded directly in GitHub and accessible from VS Code—creating a powerful Agentic DevOps loop across coding environments.