OpenText announced the launch of its Cloud Editions (CE) 25.3, a major release that helps organizations harness the power of AI, cloud, and cybersecurity to drive business outcomes.

VisionMobile has just released its new State of The Developer Nation Report for Q3 2016 based on the world's largest survey of software developers. Here at Heavybit, a program that helps developer-focused startups take their product market, we look forward to VisionMobile’s reports that allow us to keep up-to-date on the shifts in the developer landscape.

This quarter’s report delves into the key developer trends for 2016 and discusses mobile platforms, desktop platforms, server side languages, IoT markets, and the adoption of emerging technologies. Here are a few highlights from the report:

Mobile Platform Wars

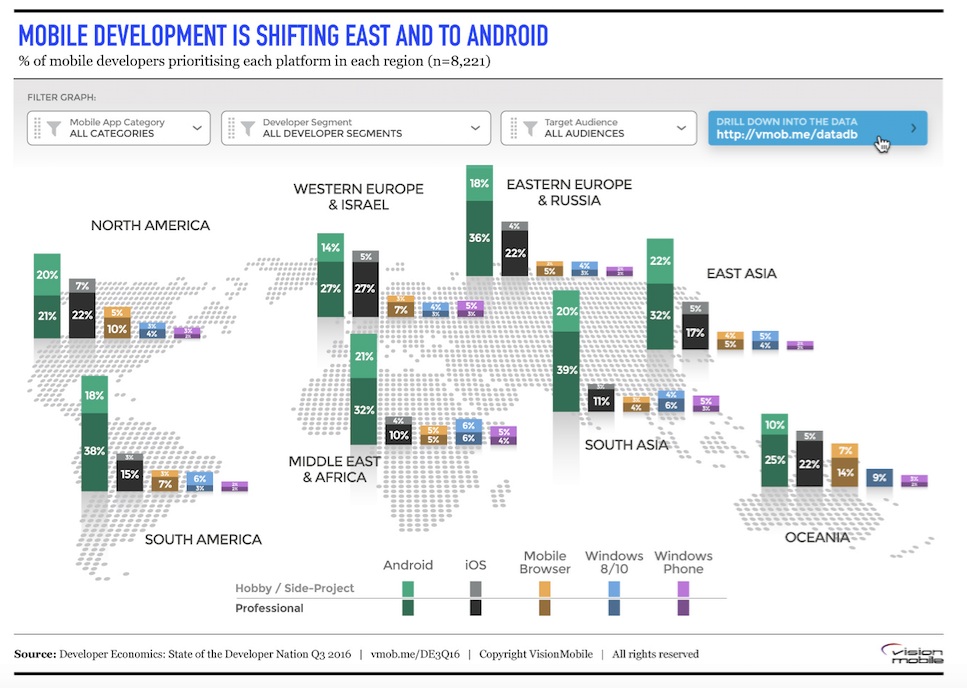

After years of stability, Android is now extending its dominance in device sales to even greater developer mindshare and priority over iOS.

In addition, Android is leaping to a new record for any platform since VisionMobile started measuring in 2010, with 79% mindshare amongst mobile developers. Interestingly, 47% of professional developers now consider Android their primary platform, up 7 percentage points in the last 6 months. Also notable, the number of professionals who consider iOS their primary platform fell 8 percentage points from 39% just six months ago to 31% in VisionMobile’s most recent survey.

When looking at geographic trends, there was a strong bias towards Android in the East and slight bias towards iOS in the West, with many more developers being based in the West.

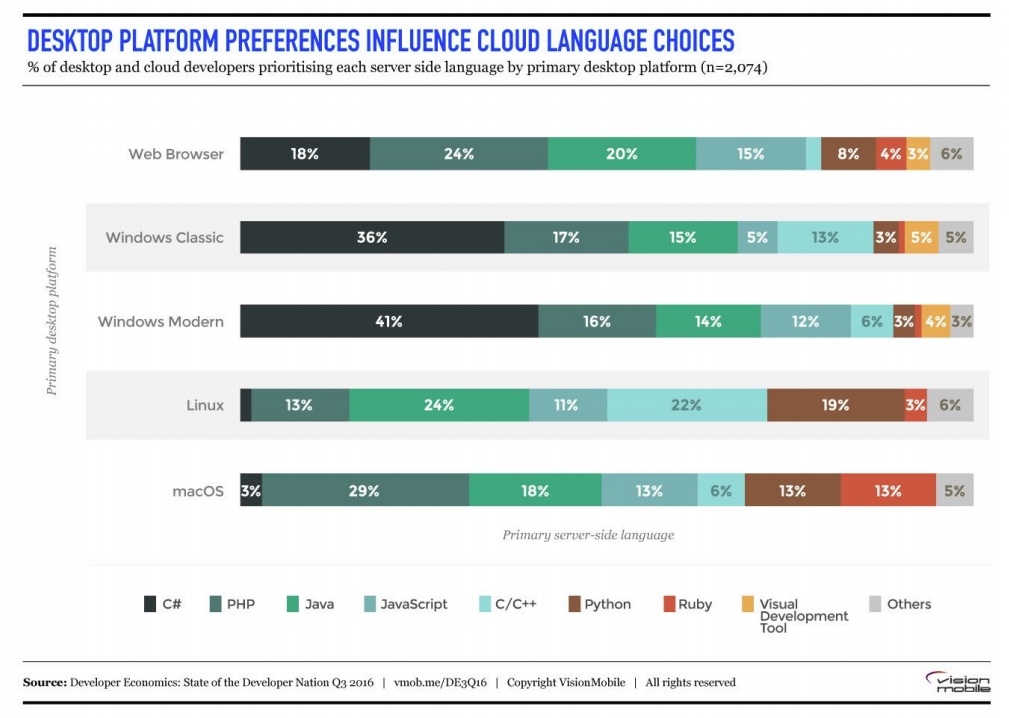

Desktop and Cloud Developer Tribes

Developers can be quite a tribal bunch. They often band together around particular technology clusters, engaging in endless ideological or technical debates with those that choose other technologies about which is "best." A lot of developers, although far from all, can end up living within particular technology ecosystems, and learning new technologies from within those to solve new problems.

Microsoft is clearly having some success shepherding Windows classic developers towards newer technologies; an impressive 36% primarily use C# on the server. Developers that primarily target Linux or macOS on the desktop are extremely unlikely to use C# on the server. Just 2% of Linux-first developers and 3% of those that prefer macOS are primarily using C# for their backend.

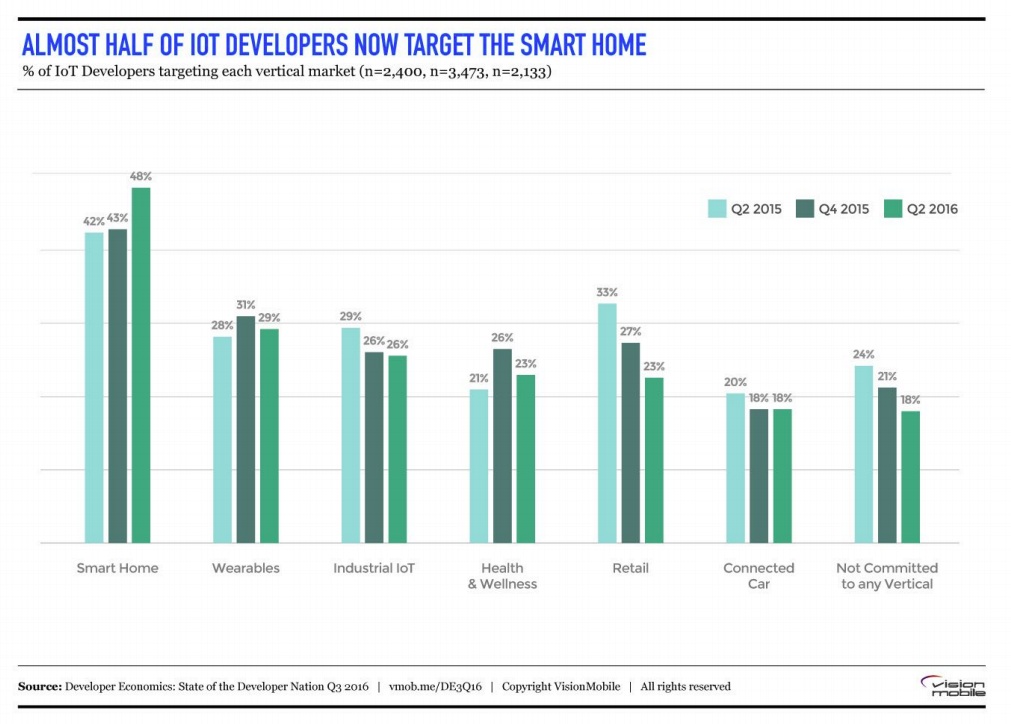

A New Phase in the IoT Market

The wave of IoT newcomers is coming to an end. Throughout 2015 roughly half of the IoT developer population were newbies – 57% in our Q2 2015 survey, and 47% in Q4 2015 had less than an a year of experience, that proportion dropped to 22% in Q2 2016.

In regards to verticals, VisionMobile is starting to get a large pool of fairly experienced IoT developers who know what they’re after; a more mature, more focused, IoT community. And what’s the first vertical that many IoT developers pick? Smart Home. Almost half (48%) of the IoT developer population now targets the Smart Home. The next most popular vertical is Wearables, at 29% a distant second. Smart Home is not just the biggest vertical in terms of developer interest, but also the fastest growing – up from 42% a year earlier.

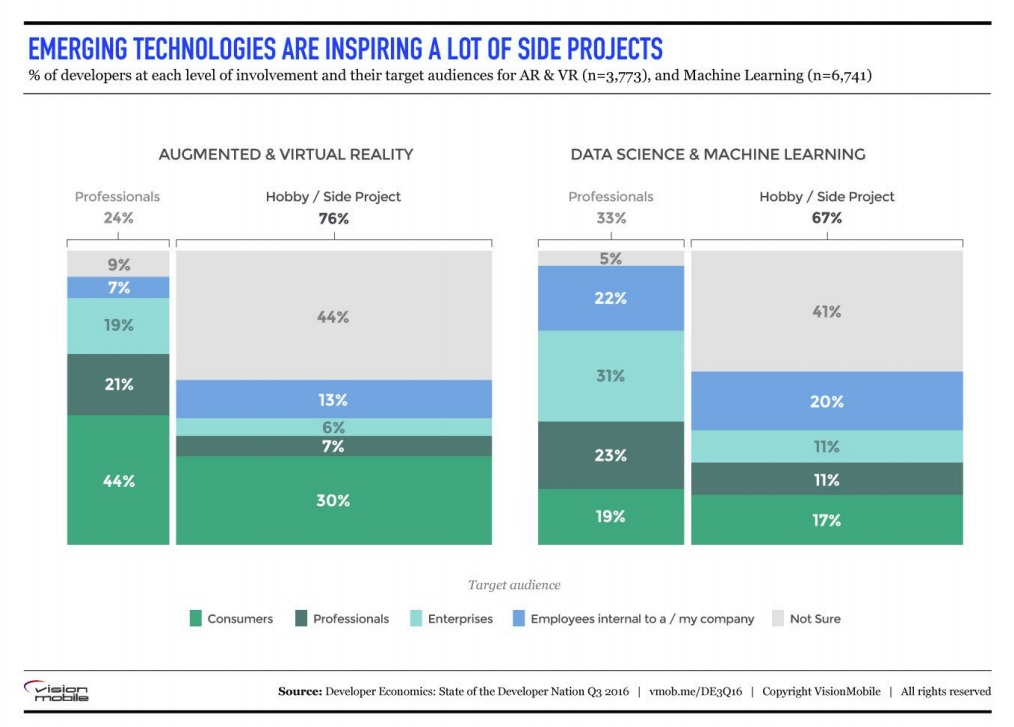

Where Are Developers Looking Next?

Where are developers looking next? Augmented and virtual reality, and machine learning – are they just the latest over-hyped technologies or the next big things? The level of developer interest in both areas suggests the latter. Nearly 23% of developers are already involved in either AR or VR development, most of those as a hobby or side project. An amazing 41% of developers are involved in data science or machine learning in some way, 33% of those in a professional capacity.

The survey reached an impressive 16,500+ respondents from 145 countries around the world. This Developer Economics series continues to be the most global independent research on mobile, desktop, IoT and cloud developers combined ever conducted.

Malia Powers is Communications Manager at Heavybit

Industry News

CircleCI launched its Platform Team Toolkit, a comprehensive solution that eliminates the need for organizations to choose between organizational control and developer velocity.

Harness announced new DevOps Capabilities for Harness AI.

Cycode announced the launch of its AI Exploitability Agent.

GitLab announced the public beta launch of GitLab Duo Agent Platform, a DevSecOps orchestration platform designed to unlock asynchronous collaboration between developers and AI agents.

Check Point® Software Technologies Ltd.(link is external) announced it has been recognized as a Leader in The Forrester Wave™: Zero Trust Platforms, Q3 2025.

Superblocks announced the availability of the Superblocks Platform in the new AI Agents and Tools category of AWS Marketplace.

Kong announced Kong AI Gateway 3.11 with several new features critical in building modern and reliable AI agents in production.

Legit Security announced enhanced capabilities for significant code change and workflow orchestration within its platform.

Couchbase announced the availability of Couchbase Capella™ in the new AI Agents and Tools category of AWS Marketplace.

CloudBees announced the availability of the CloudBees Modern Context Protocol (MCP) Server, the latest innovation behind CloudBees Unify, in the new AI Agents and Tools category of AWS Marketplace.

CircleCI announced the availability of the CircleCI Model Context Protocol (MCP) server in the new AI Agents and Tools category of AWS Marketplace.

Sonatype announced the availability of its entire product suite, including Nexus Repository Cloud, in the new AI Agents and Tools storefront in AWS Marketplace.

Perforce Software launched a breakthrough in agentic AI testing with the ability to turn plain language inputs into resilient, execution-ready test actions.